Launching an accounting firm takes more than industry knowledge. It requires a sharp business strategy, strong operational systems, and an expert approach to managing talent. Most new firms hit roadblocks early due to poor planning, low retention, or a lack of niche positioning. This article breaks down how to build a solid foundation in your first year so you can grow with clarity and confidence.

Key Highlights

- Choosing the right business model influences long-term stability

- Pricing and positioning define how your firm attracts ideal clients

- Staff retention starts with recruiting professionals aligned with your values

- The right systems reduce burnout and increase client retention

- Marketing works when you know your target niche and speak their language

- You don’t need to offer everything—own your core service

- Referrals don’t happen by accident; they need structure and strategy

Lay the Foundation with the Right Business Structure

Start by deciding how your firm will operate: sole proprietorship, partnership, or limited company. The structure affects taxes, liability, and how you manage cash flow. Most accounting professionals skip this discussion and later pay for it in restructuring fees or tax mistakes.

Create a legal framework that supports your growth goals. If you plan to scale, set up as a limited company and separate personal assets. Register for a business bank account and set clear payment policies early. Build compliance into your core workflows—not as an afterthought.

Pricing Strategy Must Match Your Ideal Client

Undercutting big firms on price won’t win you long-term clients. Focus instead on value-based pricing tied to your niche.

For example:

If your niche is small e-commerce businesses, build fixed-rate packages around VAT returns, inventory management, and profit margin analysis. Avoid hourly billing. It doesn’t reflect your value or help you scale.

Too many new firms try to be generalists. You don’t need to serve everyone. You need to serve a clear market better than anyone else.

Invest in Talent from Day One

Hiring smart is non-negotiable. You won’t scale with part-time contractors who see your firm as a temporary gig. Even in year one, commit to team development.

If you don’t have the internal bandwidth to handle recruitment, work with a specialist in accounting talent acquisition. One strong hire in your niche will beat five average freelancers.

Accountancy Capital is a reliable partner for this. They connect accounting firms with vetted finance professionals who match both the technical skill set and the cultural values of your business. Their candidate pool is deep, and their process saves you time during those critical early months when every hour matters.

Your Onboarding Process Drives Retention

Turnover destroys young firms. Even if your hires are brilliant, they won’t stay if your systems are chaotic.

Build an onboarding playbook. Make every team member feel aligned with your mission, your goals, and your operating rhythm. Show them how their work fits into client success. Use standard operating procedures (SOPs) for everything—client meetings, file sharing, monthly reporting.

If you skip this step, your firm becomes reactionary. That creates friction. And friction pushes good talent out the door.

Choose a Scalable Tech Stack Early

Start lean but smart. Avoid bloated tools with features you don’t use. Pick accounting software that integrates cleanly with CRM and project management tools. Your clients should never need to chase you for updates or repeat the same info twice.

Tech stack essentials:

- Cloud-based accounting software (Xero or QuickBooks)

- Time tracking and billing automation

- CRM for client relationship visibility

- File sharing with bank-level security

- Workflow automation to reduce manual tasks

Keep things simple. You can always upgrade later. But what you can’t do is waste months switching tools mid-growth.

Your Brand Must Be Clear, Not Clever

Clients don’t buy clever taglines. They buy confidence. Your website, email, and onboarding materials must clearly state what you do, who you serve, and how you deliver value.

Do not try to look like every other accounting firm. Show real results. Use testimonials. Add a pricing page. Display case studies with measurable outcomes.

If you serve creatives, don’t use corporate jargon. If you serve medical professionals, speak in compliance outcomes. Match your language to the world your clients live in.

Marketing Without a Niche Fails

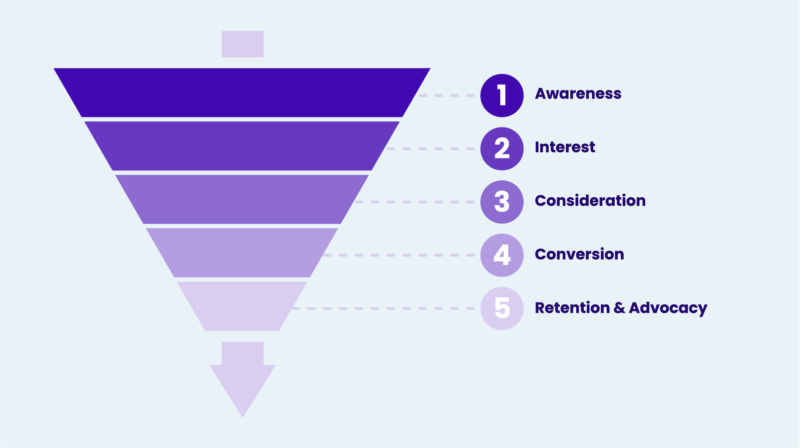

Marketing doesn’t mean posting on LinkedIn once a week and hoping someone bites. You need a focused client profile and a marketing funnel built to attract and convert them.

Create a simple funnel:

- Identify your ideal industry (e.g., online coaches, independent consultants, or ecommerce stores)

- Build lead magnets—free tax checklists, cash flow guides, or VAT tips

- Use email nurturing to educate and pre-sell your services

- Offer short discovery calls with structured questions

Cold DMs and Google Ads won’t work if your offer is vague. But if you speak directly to one audience, you become a magnet in that space.

Be Ruthless About Scope Creep

One mistake new firms make is trying to please every client. That’s a race to exhaustion. Set clear service boundaries. Say no to anything that falls outside your expertise.

Use engagement letters with strict deliverables. Add fees for extra requests. Train your team to push back professionally but firmly. Your profit margins depend on it.

Clients don’t leave because you have boundaries. They leave when you overpromise and underdeliver.

Build Referral Engines, Not Wishes

Word of mouth grows a firm faster than any ad. But referrals don’t happen by magic.

Create referral systems:

- Set up referral rewards for clients and partners

- Ask satisfied clients for introductions within 30 days of closing projects

- Partner with lawyers, consultants, and financial planners who serve your same niche

- Track and report your referral wins

Referrals must be structured and intentional. Treat them like a channel, not a hope.

Build with Exit in Mind

Even if you plan to run your firm forever, operate it like you’ll sell in five years. Build processes that run without you. Document everything. Track client profitability.

A firm that depends on your presence cannot scale. It cannot attract investors. It cannot survive key employee loss. Protect your assets by designing for autonomy.

Final Thought: Don’t Copy. Build with Purpose

Every firm has different goals. Some want lifestyle freedom. Others want to scale and dominate. But no path works if it lacks purpose and structure.

The first year will test your patience, your strategy, and your leadership. But it will also show you who your ideal clients are, what services you truly enjoy offering, and where your competitive edge lies.

Start with a tight foundation. Hire with vision. Systemize early. Position with clarity.

That’s how real firms grow. That’s how you build one that lasts.